Compliance

The Compliance component is available only to users who have been designated as Risk Managers upon initial setup with Rival Systems. Any users without this designation will not see the Compliance component displayed in their Component Panel.

Compliance limits are set at the Group level and apply to all Users within that Group. Limits may be set per Symbol for a Group, using exchange symbology. If limits are not specified for an individual Symbol, the Default limit settings are used.

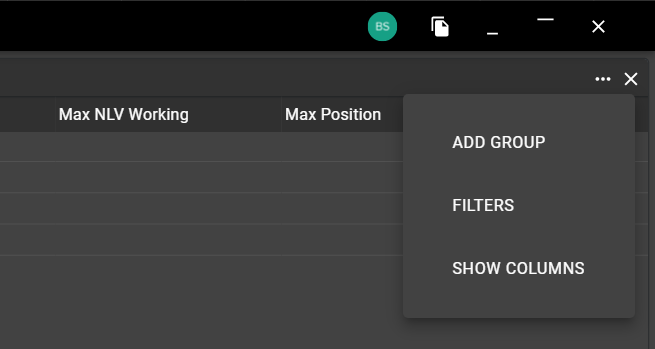

As with other components, Risk Managers can use the ellipsis menu to customize their view of the Compliance component by applying specific filters or showing and hiding specific columns. From the same location, Risk Managers can add a new Group.

Adding Limits

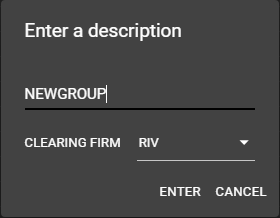

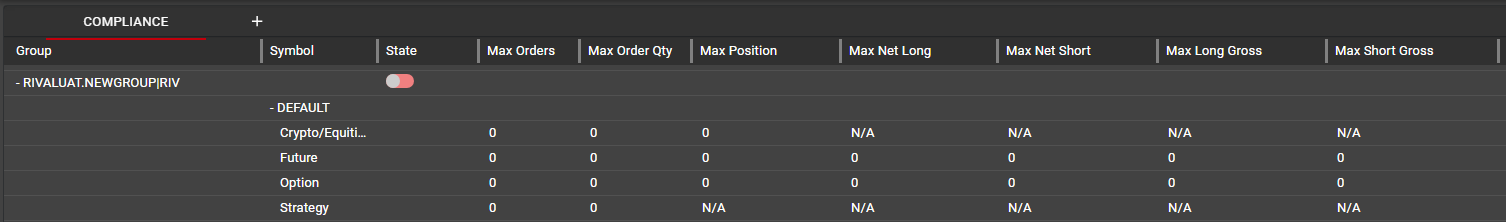

When adding a new Group, users will be prompted to specify a Clearing Firm. Only the permissioned Clearing Firm(s) will be displayed to the user. This ensures that for Rival One users clearing with multiple Clearing Firms, their Compliance limits are accessible only to the permissioned Risk Manager for the Clearing Firm and obscured from any other Risk Managers associated with other Clearing Firms.

The new Group will now display as Firm.Groupname|Clearingfirm, as shown below. For newly added Groups, the Compliance State will default to Disabled, indicated by the red color on in the State toggle below. Limits may be enabled or disabled only at the Group level. In order to provide as much security as possible when setting up limits, all limits will default to zero, both in the Default category and for any new Symbol that is added to Compliance.

When entering or changing a limit, the new values are displayed as staged entries, highlighted in yellow. Staged entries will not take effect until the changes are saved by the Risk Manager by clicking ‘Save’ in the upper right corner of the Compliance component. The ‘Revert’ feature can be used to discard any staged entries before they are saved.

Limits are then set per Asset Class within the Symbol (or within Default settings). Available Asset Classes are:

Crypto/Equities

Future

Option

Strategy

In all cases where there are multiple limits set for an Asset Class--either in Default settings or in an individual symbol--the most restrictive limit will always be enforced.

Available Limits

Max Orders: Total number of active orders allowed per symbol at any time. The Max Order limit will apply to Buy and Sell orders separately. For example, a Max Order limit of 5 will allow for both 5 active Buy orders and 5 active Sell orders at any given time.

Max Order Qty: Maximum size allowed per order. For Strategies, this limit applies to the quantity of the order, irrespective of the number of individual legs in the Strategy.

Max Order NLV (Net Liquidation Value): Maximum notional value (Net Liquidation Value) allowed per order. This limit does not currently apply to Strategies.

NLV = (Contract Price) x (Order Qty) x (Contract Size)

Max Day NLV Total buying power consumed, based on NLV. This limit will track all cash debits and credits for options and option spreads within the specified Base Symbol in the current trading session. Only option premium is considered for this limit, and it is not applicable for Futures or Crypto/Equities, as indicated by the N/A in those fields.

Max Position: Maximum net position (Long or Short), inclusive of all filled and working orders. Max Position will always account for a worst-case scenario by including working orders (potential positions). An order may not be placed if it would breach the Max Position limit when filled.

Max Position is applied at the Base Symbol (aka Product Family) level. See examples below for more detail.

This limit applies only to outright contracts. Strategy orders are subject to outright position limits based on leg quantities in the Strategy. A Strategy order may not be placed if a fill would result in a breach of Max Position in any individual leg of the Strategy.

Max Long Gross: Maximum quantity of all filled and working Buy orders. Strategy orders are subject to outright Max Long Gross limits per leg.

Max Short Gross: Maximum quantity of all filled and working Sell orders. Strategy orders are subject to outright Max Short Gross limits per leg.

Note: Max Long Gross and Max Short Gross are applied at the Base Symbol level, as Max position is. These Gross limits are in place in large part to prevent large spread positions from being put on, which would not violate the Max Position limit. See examples below for more detail.

Max Net Long: Maximum net long position of all filled and working orders. As with Max Position limit, Strategy orders are subject to outright net long limits.

Max Net Short: Maximum net short position of all filled and working orders. As with Max Position limit, Strategy orders are subject to outright net short limits.

Note: Max Net Long and Max Net Short are applied at the Instrument level, not at the Base Symbol level. See examples below for detail.

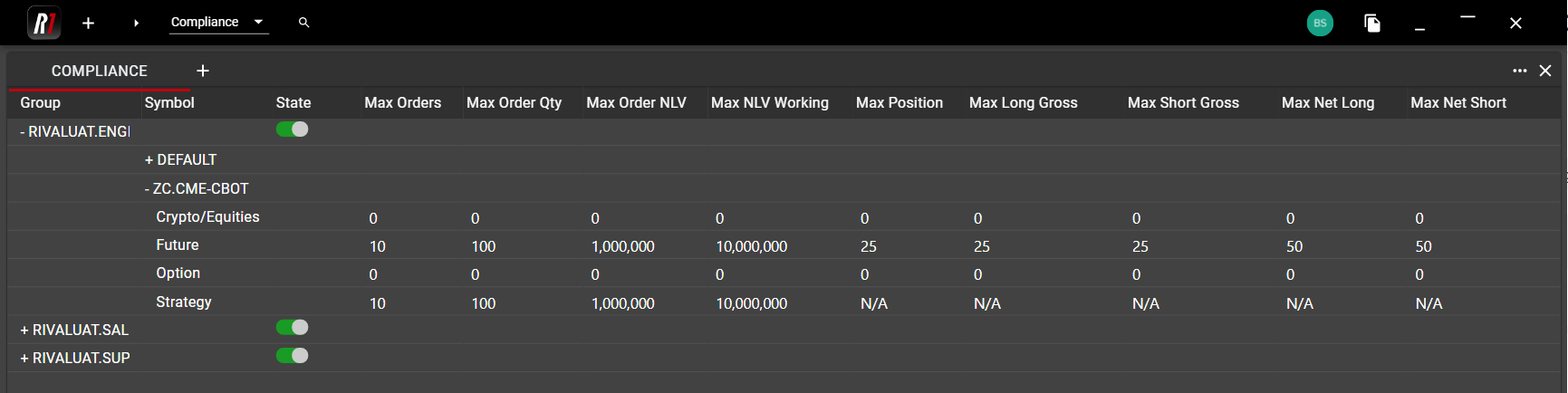

Example: Limits have been set for the ZC.CME Product Family with the following values:

User makes the following trades:

Buy 10 ZCZ3

Sell 15 ZCH4

User's Total Position--applied to the Max position limit--is (5), because the Max Position limit is being applied at the Base Symbol level.

User's Net Long position is 10 in ZCZ3

User's Net Sort position is (15) in ZCH4

User's Gross Long position is 10, applied at the Base Symbol level.

User's Gross Short position is (15), applied at the Base Symbol level.

User now makes the following trades:

Buy 15 more ZCZ3

Sell 10 more ZCH4

User's Total Position is now zero (0), because the user is net flat ZC contracts, and the Max Position limit is being applied at the Base Symbol level.

User's Net Long position is 25 in ZCZ3

User's Net Short position is (25) in ZCH4

User's Gross Long position is 25, applied at the Base Symbol level.

User's Gross Short position is (25), applied at the Base Symbol level.

This means that the user cannot add to their position in either ZCZ3 or ZCH4, or else they will violate their Gross position limits. This is an example of how Gross limits prevent users from getting around their net limits by trading spreads.