Portfolio

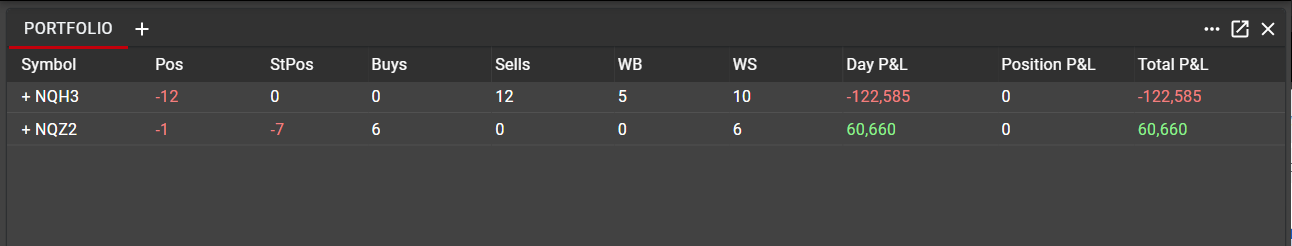

The Portfolio component contains information on all positions—both Start-of-Day and session activity—as well as P&L for all instruments traded by the user.

Data in Portfolio

The following columns are available for all positions. Any of these columns can be shown or hidden using the ellipsis menu, and may be rearranged by dragging, dropping or re-sizing individual columns according to the user’s preference.

Symbol: The exchange-defined symbol of the Instrument

Category: Category into which the Instrument falls. This column can be most useful when applying filters, as detailed in the section below.

Pos: Current total position in the Instrument

StPos: Starting position, aka Start-of-Day or SOD position. Indicates the user’s position in the Instrument at the beginning of the current trading session.

Buys: Total Buys in the Instrument in the current trading session.

Sells: Total Sells in the Instrument in the current trading session.

WB: Working Buys. Indicates the total quantity of contracts in open Buy orders for the Instrument, irrespective of the trading session in which the orders were entered.

WS: Working Sells. Indicates the total quantity of contracts in open Sell orders for the Instrument, irrespective of the trading session in which the orders were entered.

Day P&L: Total P&L of all trades during the current trading session.

Position P&L: P&L of the Start-of-Day position in the Instrument.

Settlement P&L: P&L of the position post-settlement, using the current settlement price as reference.

Total P&L: Aggregate of all P&L measurements.

Open NLV: Net Liquidation Value of the position at the start of the trading session.

Current NLV: Current Net Liquidation Value of the position.

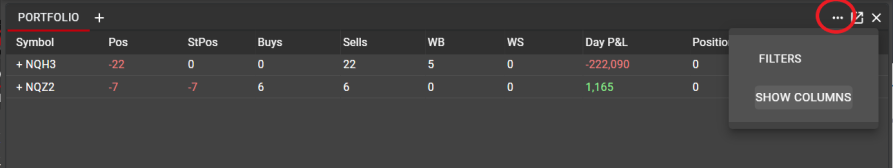

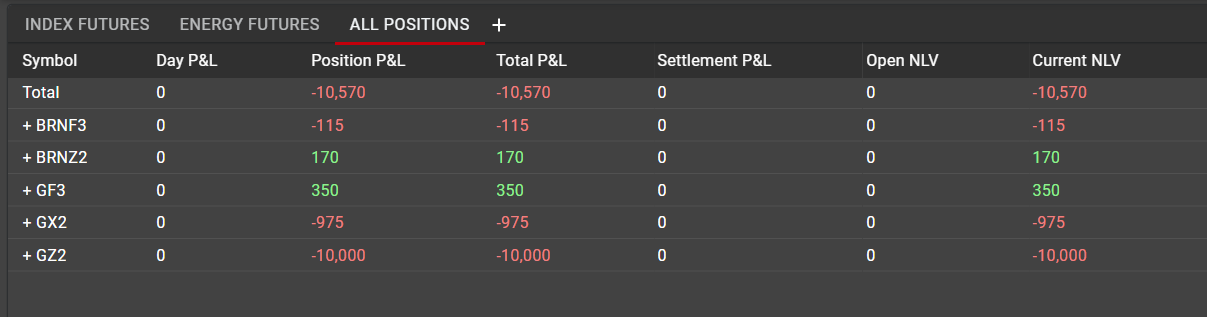

Sorting and Filtering in Portfolio

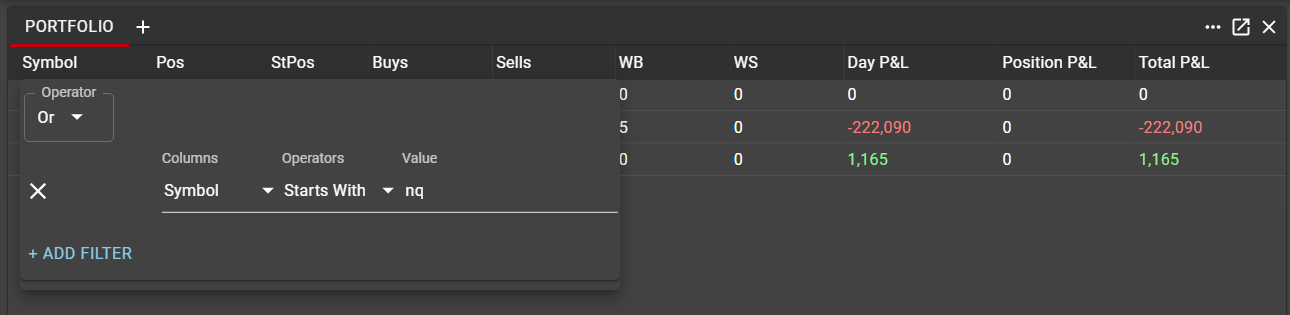

As with other components in Rival One, filters may be applied to data in the Portfolio in an and/or configuration, based on criteria for one or more columns. This is most often used to filter orders for a particular Symbol or group of Symbols.

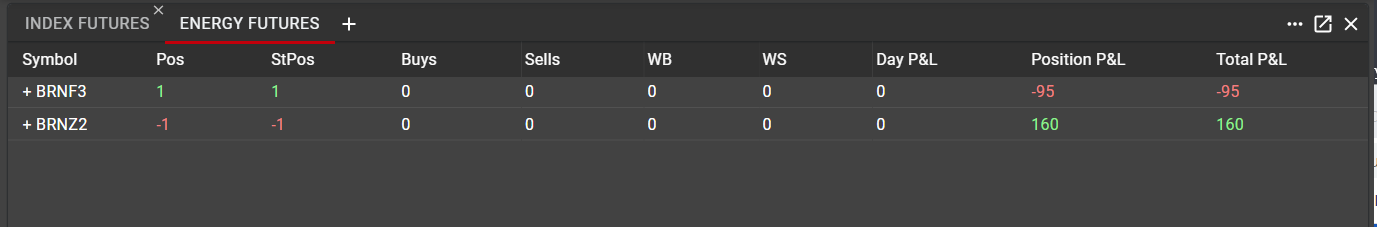

Using tabs in the Portfolio component can provide additional categorization for users trading across multiple Symbols or Asset Classes. Tabs can be added at any time and renamed, and tab-specific filters may be applied in order to monitor individual positions more accurately.

The Total row in Portfolio aggregates data for all filtered positions. If no filter is applied, Total row will aggregate data for all of the user’s positions. If a filter is applied, the Total row will aggregate data for only those positions included in the filter.

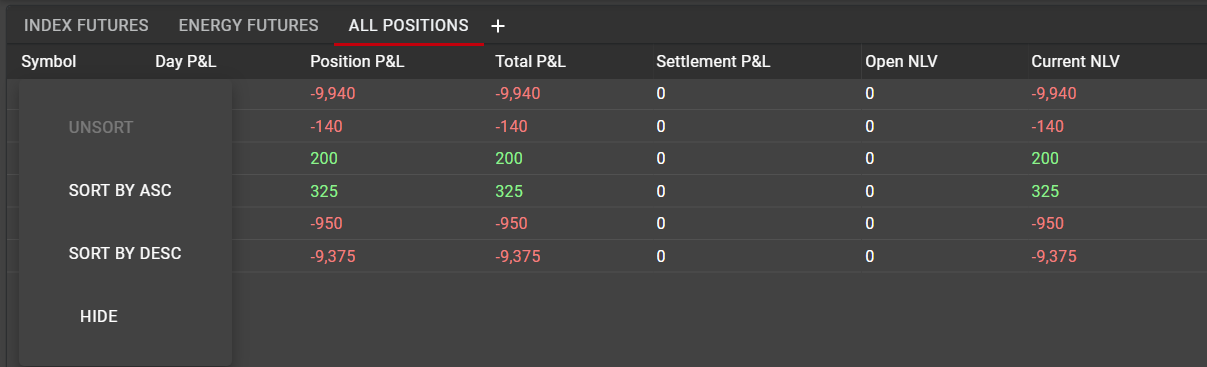

In addition to filtering, any column in Portfolio may be sorted. Right-click in the column header to expose the context menu. From this menu, users can apply or remove a sort or may hide the column altogether.

Spreads in Portfolio

Multi-leg exchange-listed spreads are treated differently in Portfolio component than outright instruments. A spread will only appear in Portfolio when there is a working order in the spread, in which case the only columns populated for that order will be WB/WS (Working Buys/Working Sells).

Once a spread instrument has been filled, Portfolio will manage and track only the individual legs of the spread and will calculate Positions, P&L and NLV based on the legs, rather than the spread. This is true for both exchange-listed spreads as well as synthetic spreads created using Spreader.

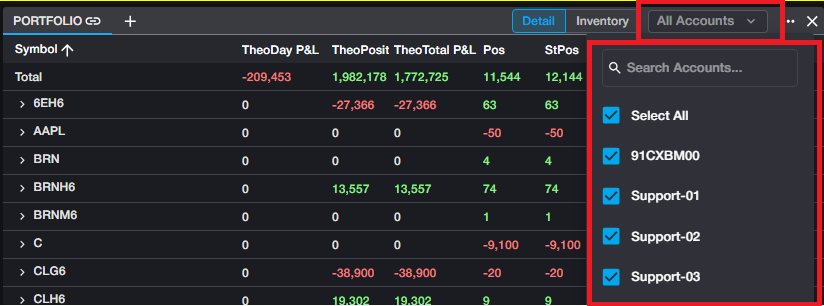

Account Selection in Portfolio

In the case that the user has access to more than one Account, positions within the Portfolio can be viewed by a single Account or by a group of Accounts selected by the user.

When more than one Account is available, users will see this dropdown in the header.

By default, all Accounts are selected. Users can amend this selection to include one or more selected Accounts, in order to display the positions within those Accounts exclusively.

Note that the Account selection is unique to each tab in the Portfolio, allowing users to view positions for each Account in separate tabs if desired.

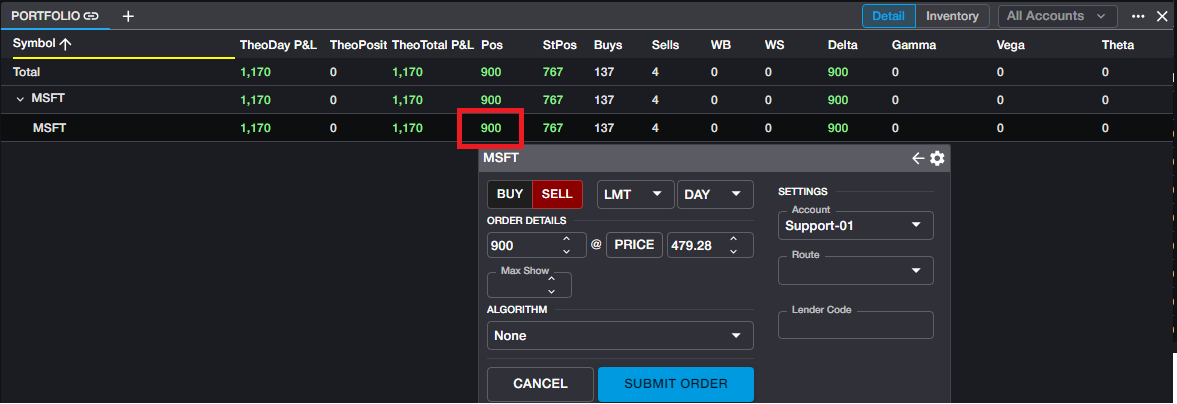

Execute from Portfolio

Users have the ability to manage any open positions from the Portfolio. A single left click on any position within the Portfolio will open an Order Ticket for that instrument. The Order Ticket will populate with the last traded price and with the side and quantity that will close the position. These inputs can be edited by the user.

For example, in the below screenshot, the user is long 900 shares of MSFT. Clicking on that position will open an Order Ticket to sell 900 shares at the current price of 479.28.

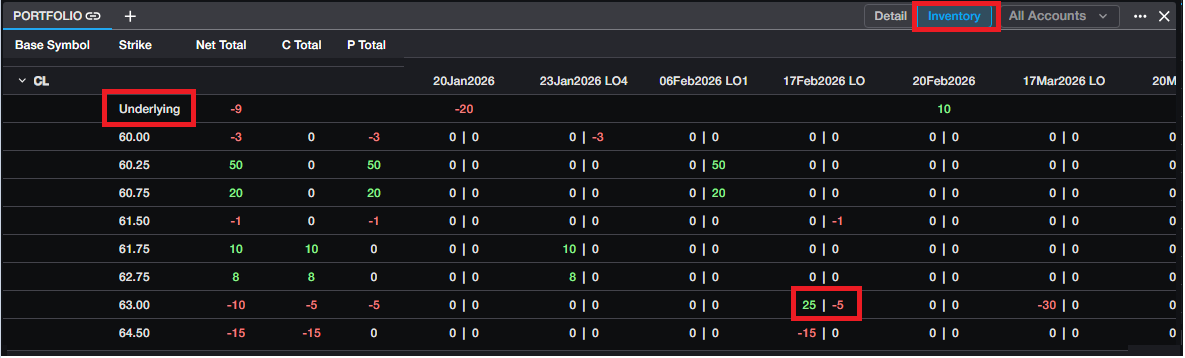

Inventory View

By default, the Portfolio opens in Detail view, where users can customize the columns listed above. Portfolio also offers an Inventory View, to allow users to view their inventory across all terms within a selected complex. This view is specifically designed to help manage Option positions, but all positions are included in the Inventory View.

Note that the underlying quantity, highlighted above, will be displayed on the top line of the product inventory view.

Calls and Puts are separated by the pipe symbol within each Term. For example, in the above screenshot, this user is long 25 Calls on the Feb 63.00 strike and short 5 Puts.

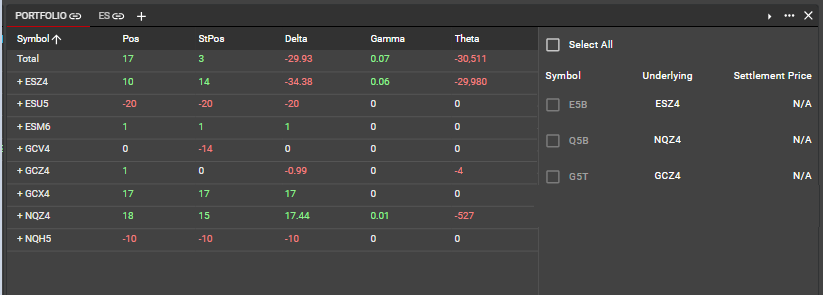

Expire Options From Portfolio

By default, the expiration process for all options will run during the standard daily maintenance window. The expiration process will remove any OTM options and will properly convert any ITM options to their assigned underlying instrument.

Users do have the ability to initiate the expiration process early, if desired, from Portfolio. In the Component menu, users will see a selection to 'EXPIRE OPTIONS.' When selected, a flyout panel will be exposed, which will list all options expiring the same day in which a user has a position.

Expiration cannot be run until a settlement price is received from the exchange. In the above screenshot, none of the settlements have yet been published. Once they are, users can select one or more option series to expire and click 'Expire Options.'

Note that this process cannot be undone, so users will be presented with a confirmation dialogue before proceeding. Note also that this process is not necessary to perform on any given day. If users do not run expiration early, the process will still run as normal during the scheduled maintenance session.