Ladder

The Ladder component provides a detailed view of the market in a specified instrument and allows users to quickly place and modify orders. Ladder also provides market data and position data for the instrument.

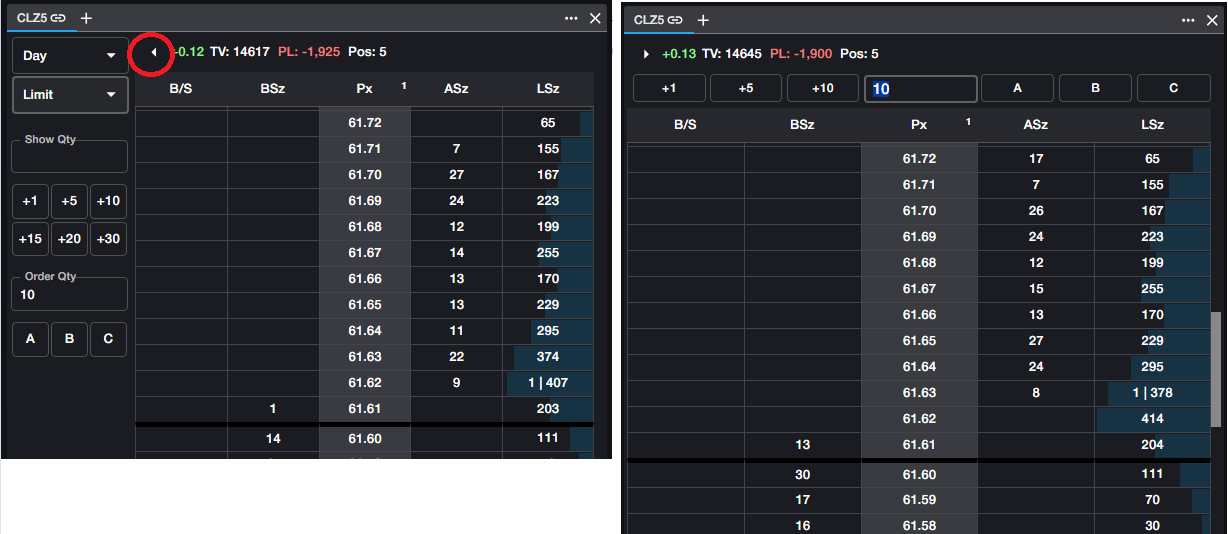

Selecting Instruments in Ladder

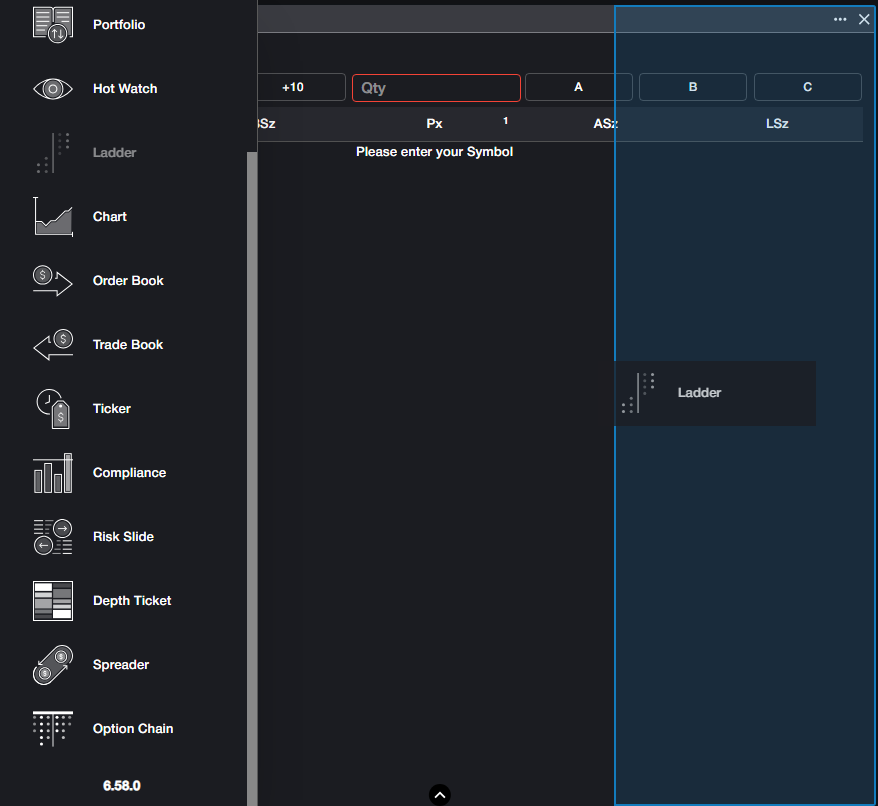

A Ladder for an instrument can be added to the workspace in two ways. From the Component Panel, click and drag the Ladder onto the canvas to open a blank Ladder with no Product selected. Click the ‘+’ in the top left corner of the component to expose the instrument search. This search behaves in the same manner as Main Search, detailed here. Once an instrument has been selected, market data will be displayed in the Ladder.

Alternatively, users may open a Ladder pre-populated with an instrument from the Main Search at the top of the workspace. Once the desired instrument has been identified, hover over the arrow to the right of the instrument to expose the floating Component Panel. From here, drag and drop the Ladder onto the canvas, where market data will be displayed immediately.

Viewing Data in Ladder

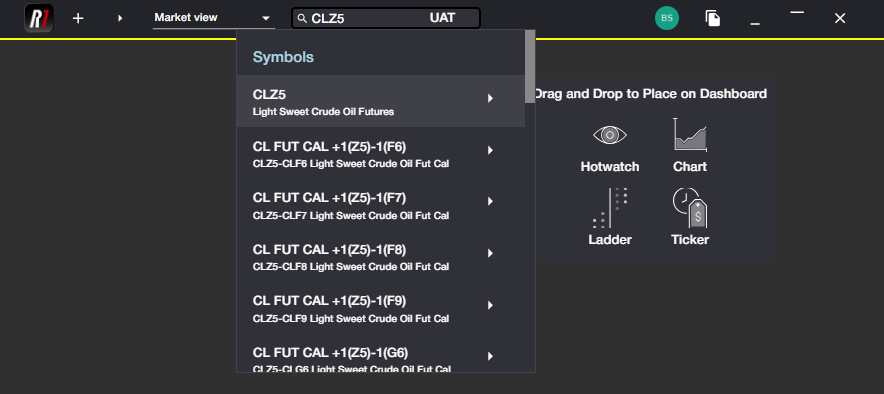

Ladder is designed to give a detailed look into the depth of the market. The following columns are displayed:

B/S: This is the Order column, where all of a user’s working orders in the selected instrument are displayed.

BSz: Displays the total quantity bid in the market at each price level.

Px: Displays price levels for the instrument.

ASz: Displays the total quantity offered in the market at each price level.

LSz: Displays the size of the most recent trade in the market at the corresponding price level.

Lsz column also displays Volume-at-Price (VAP) graphically to indicate the total size traded at each price level in the current trade session. Users can add a numerical display to the VAP bars by selecting "Display numerical values for VAP" from the Ladder menu. Once selected, numerical values will display in the LSz column, with values over 10,000 displayed in thousands(k). When numerical values are exposed, the VAP will be separated from the LSz value as seen below.

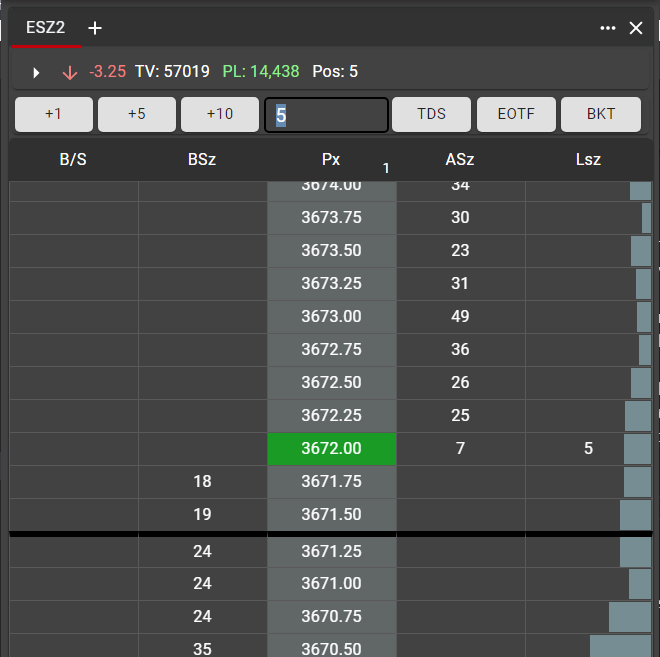

The top panel of the Ladder displays the following:

Net Change: The change in price of the instrument over the course of the current trade session. This is indicated by a green ‘up’ arrow if net change is postive, or with a red ‘down’ arrow if net change is negative.

TV: Total volume traded in the instrument in the current trade session.

PL: The user’s total profit or loss in the instrument. This is inclusive of Position P&L as well as Day P&L.

Pos: The user’s current position in the instrument.

The center line is displayed when the user centers the ladder. A single left click in the Price Column header will center the ladder at the current mid-market price.

Clicking CTRL+Space will re-center all Ladders displayed in the workspace. (Note that users must have Keyboard Shortcuts enabled in User Settings to allow for this re-centering.)

Configuring Ladder

On the left-hand side of the Ladder is the Order Panel, with the following controls available:

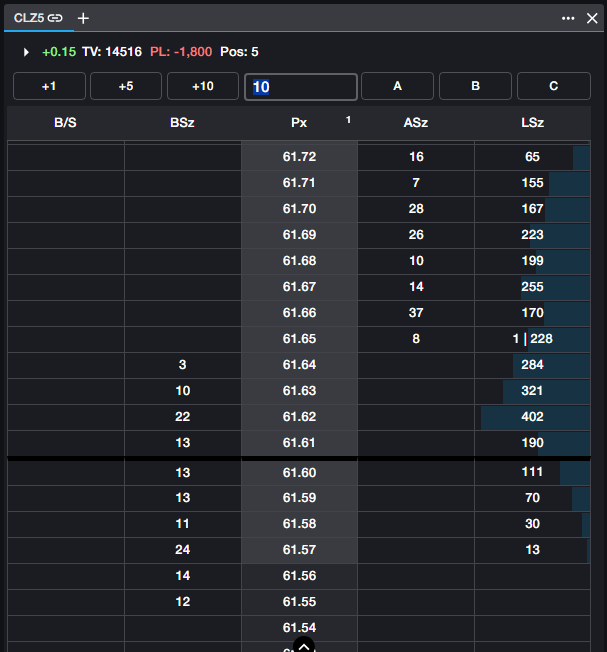

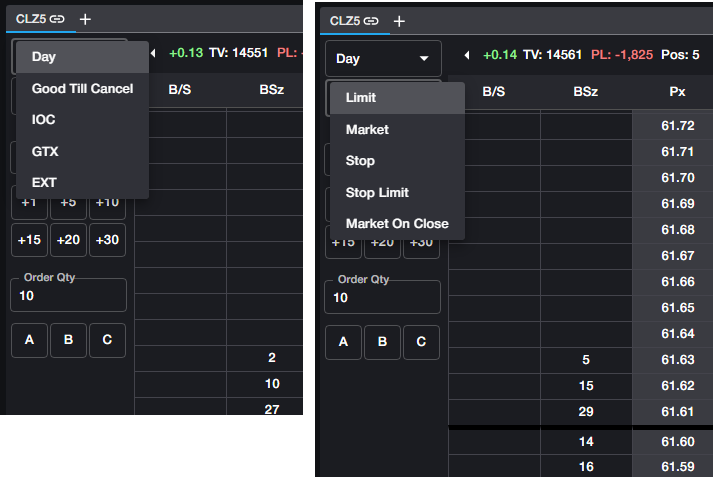

Time in Force (TIF): By default, the TIF is set to Day. The dropdown menu allows users to select the TIF for their order as long as it is supported by the exchange.

Order Type: By default, order type is Limit. Users may choose their order type from the dropdown menu, provided that the type is supported natively at the exchange.

Show Qty: Used for synthetic Iceberg orders (as opposed to exchange-supported Iceberg orders). If a quantity is entered in this field, only that quantity will be displayed to the market, rather than the total quantity of the order.

Order Qty and Order Qty buttons: The order quantity can be manually entered in the Order Qty field. The quantity buttons may be used to quickly increase the order quantity. Note that the quantity buttons are additive; clicking on a quantity button will increase the order quantity rather than overwriting what is populated in the Order Qty field.

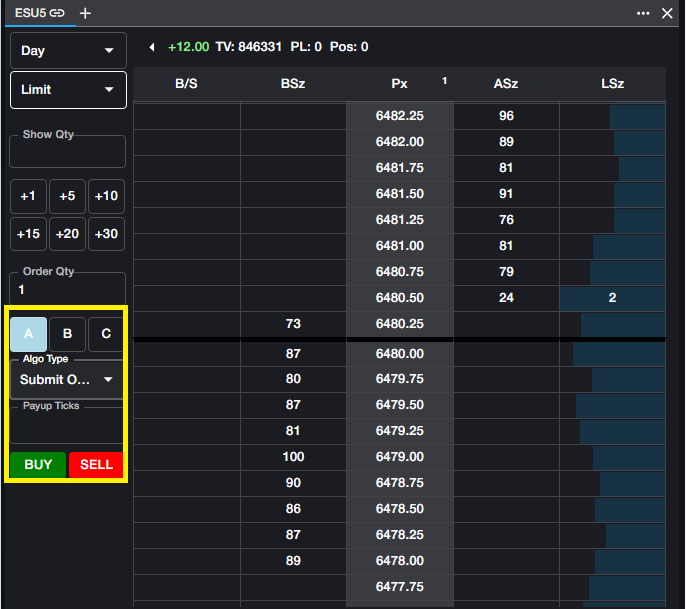

Algo Bar: Allows users to pre-configure up to 3 supported algos that can be used to enter orders. See the ‘Using Algos in Ladder’ section of this article for more detail on available algos and how they are used.

The Order Panel may be adjusted to the top of the Ladder in order to save space in the workspace. Click on the Pivot Arrow to move the Order Panel to the top of the Ladder.

The bottom panel of the Ladder is hidden by default. Clicking on the arrow at the bottom of the Ladder will expose the bottom panel. From here, users may switch between accounts, if they have access to more than one. In addition, the Cancel All button is exposed, allowing users to quickly cancel all working orders in the instrument displayed in the Ladder.

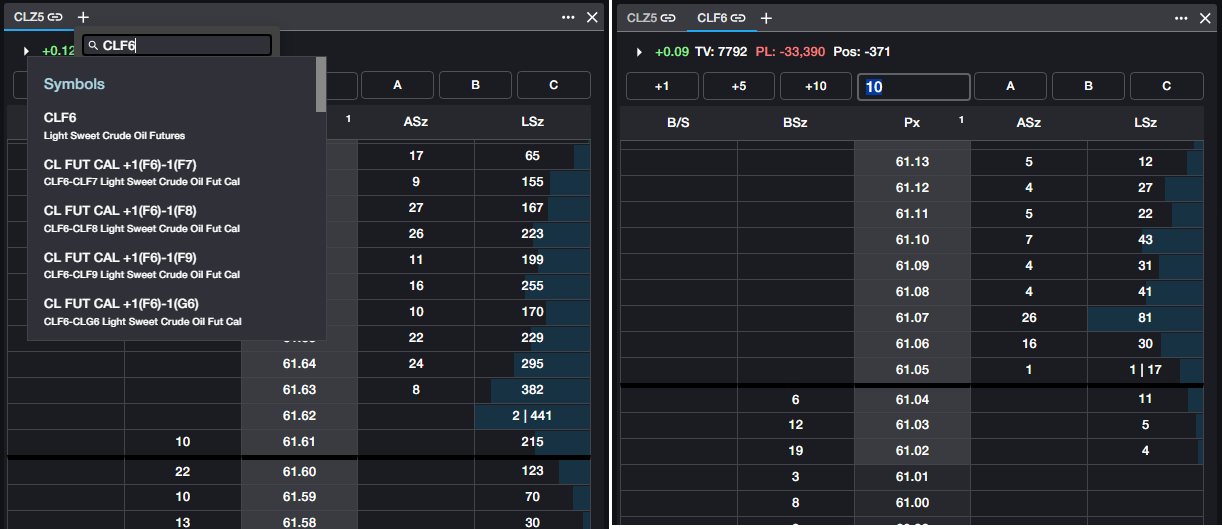

As with other Rival One components, tabs may be added to the Ladder to save space. Clicking the ‘+’ again will open a Search component. Selecting an instrument from Search will add a new tab in the existing Ladder for the new instrument. There is no limit to the number of tabs that may be added to a Ladder.

Order Entry

Once an order quantity, type and TIF have been selected, orders may be entered quickly with a single click. Left click in the BSz or ASz column at the desired price level to place an order in the market.

To work an order at a specific price level, a single left-click below the market for Buy orders--or above the market for Sell orders--will enter the order in the market.

Note that both Buy orders and Sell orders are displayed in the same Order Column. Buy orders are displayed in green, while Sell orders are displayed in red.

In order to execute an order immediately, clicking in the BSz column above the market, or clicking in the Asz column below the market will execute the order at the best bid or offer price.

Modifying Orders

All orders placed in the Ladder will remain working according to the specified TIF. In the case that a working order is outside of the visible range, an indicator will be displayed at the top or bottom of the Order Column—a red indicator at the top of the column for orders above the displayed range, or a green indicator at the bottom of the column for orders below the displayed range.

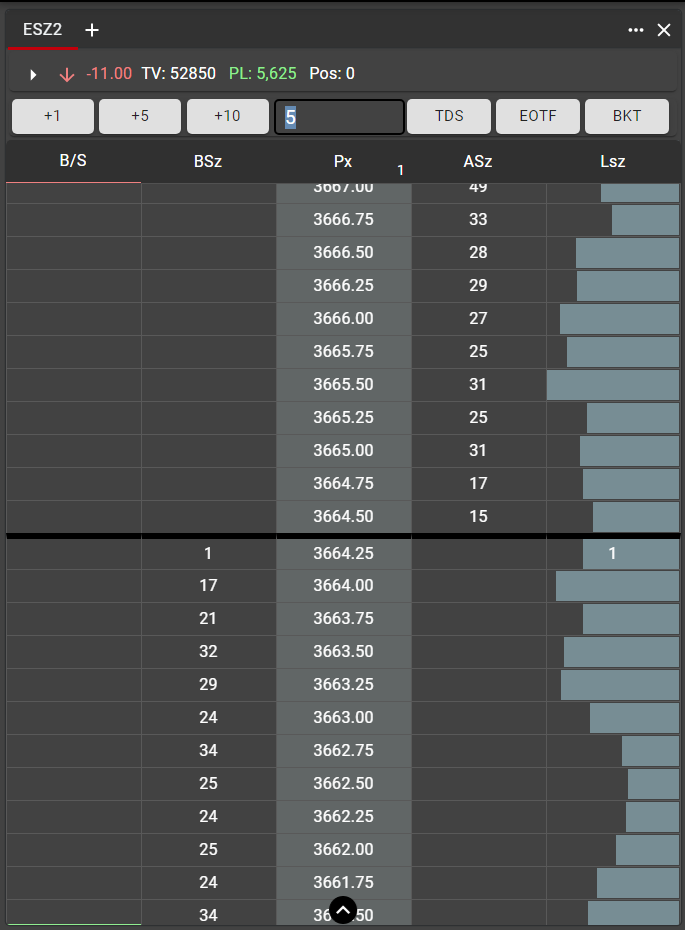

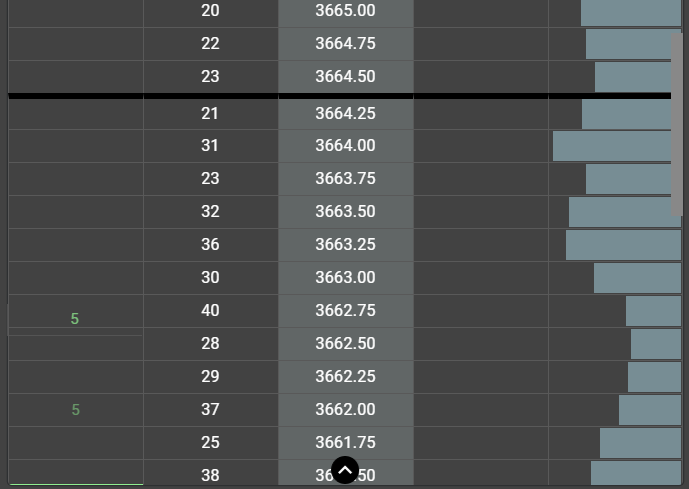

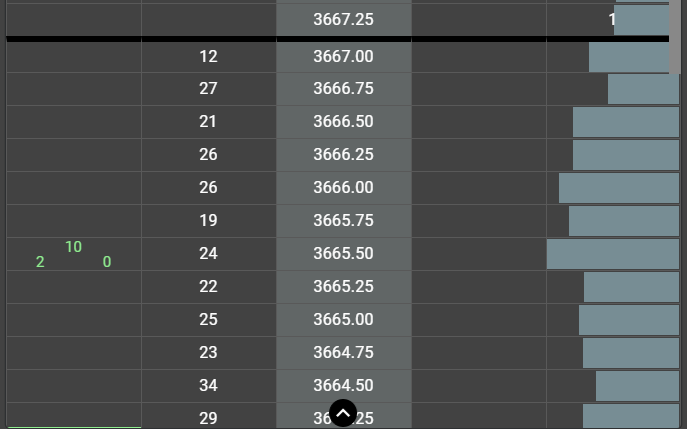

Working orders may be modified from the Ladder in two ways. Using right-click, users may drag and drop a working order to a new price level or may drag the order above the top of the book to execute it immediately. When being dragged, the original order will fade darker while the order is being moved. In the example below, the Buy order of 5 is being modified from the original price of 3662.00 to 3662.75.

Note that until the order is dropped at a new price level, it will continue to work in the market at the original level. This means that orders may be still be executed at the original price level during a manual modification.

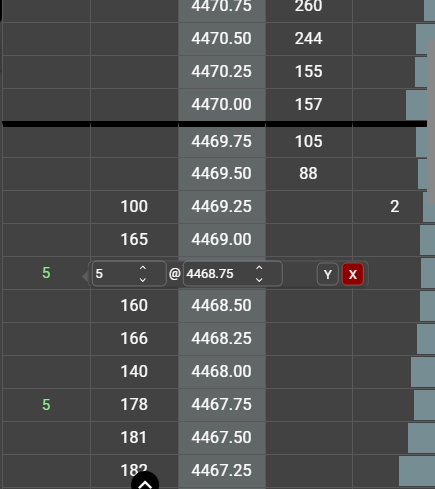

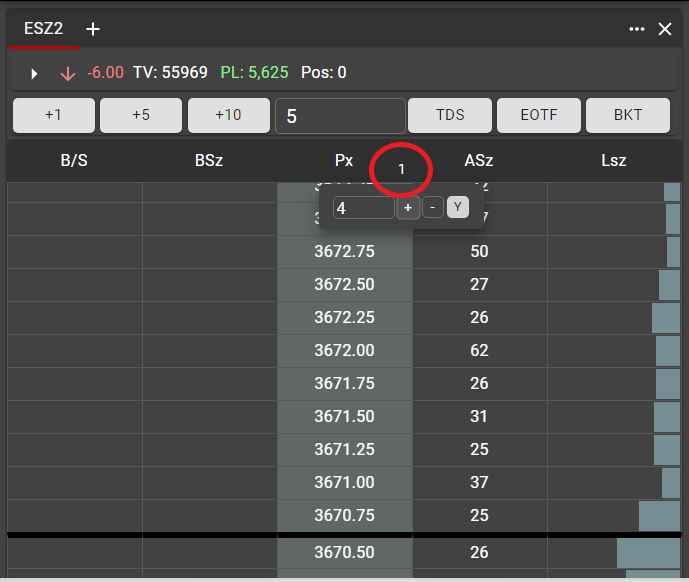

Alternatively, hovering over a working order will expose a floating Order Ticket. From this Order Ticket, order price and quantity may be modified using the arrows in each field. Clicking ‘Y’ will submit the new order details into the market. Note again that orders may still be executed at their original price and quantity while the user is performing this modification.

If two orders are placed at the same price level, the working order display will change to show the aggregate orders.

This display indicates that the user has a total of 2 orders at the price level, a total quantity of 10, and a filled quantity of zero. This can be further illustrated using the floating Order Ticket to display multiple orders.

Cancelling Orders

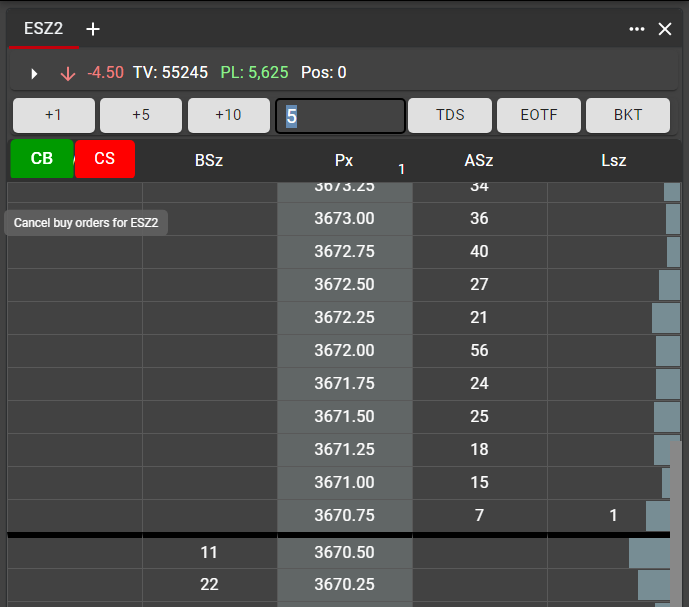

Orders may be cancelled from the Ladder in several ways. A single left click on a working order will cancel that order immediately.

Hovering over the Order Column header will expose the CB/CS buttons. A single click on CB will cancel all working Buy orders in the instrument displayed in the Ladder. A single click on CS will cance all working Sell orders in the instrument.

As mentioned in the ‘Configuring Ladder’ section of this article, opening the bottom panel of the Ladder will expose the Cancel All button. This can be used to cancel all working orders—both Buys and Sells—in the displayed instrument.

Configuring Price Display

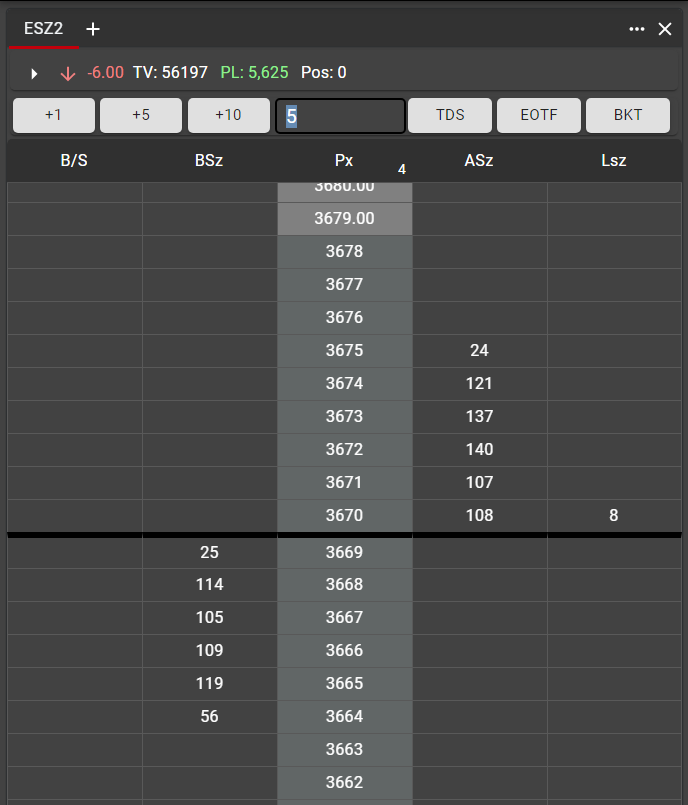

Ladder display may be further customized by using the Tick Consolidation feature. By default, all price levels will be displayed in the exchange-defined tick intervals. Users may choose to consolidate this price display by clicking on the displayed number at the top of the Price column.

Users may specify the number of ticks to consolidate at each displayed price level. In this example, the Ladder has been configured to display 4 ticks at each price level.

When consolidated, all market data is rounded away. This means that any bids in the market that are between displayed price levels will be aggregated and displayed at the lower price level. All offers in the market between displayed price levels will be aggregated at the higher price level. In the example above, the quantity of 108 offered at 3670 represents all offers in the market between 3669.25 and 3670.00. The bid quantity of 25 represents all bids in the market between 3669.00 and 3669.75.

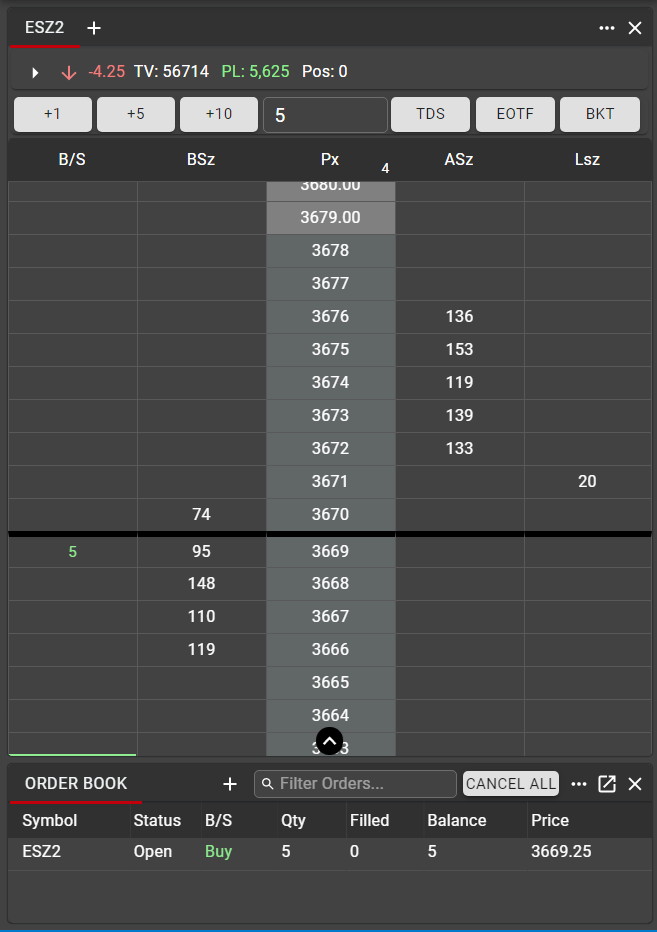

The same is true for the user’s own orders. If an order is entered at a price in between displayed price levels, it will display as a working order at the lower price level for bids or at the higher price level for offers. In the example below, the Order Book shows that this Buy order is working at a price of 3669.25, and the Ladder displays the order rounded away at 3669.

Position Data in Ladder

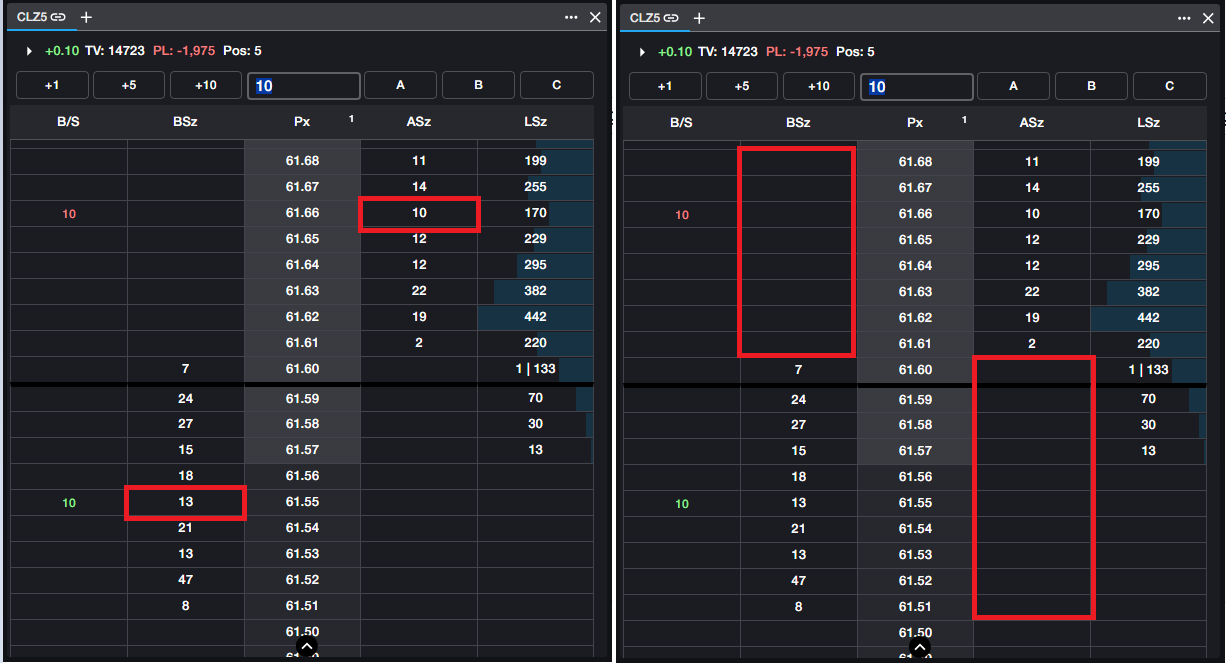

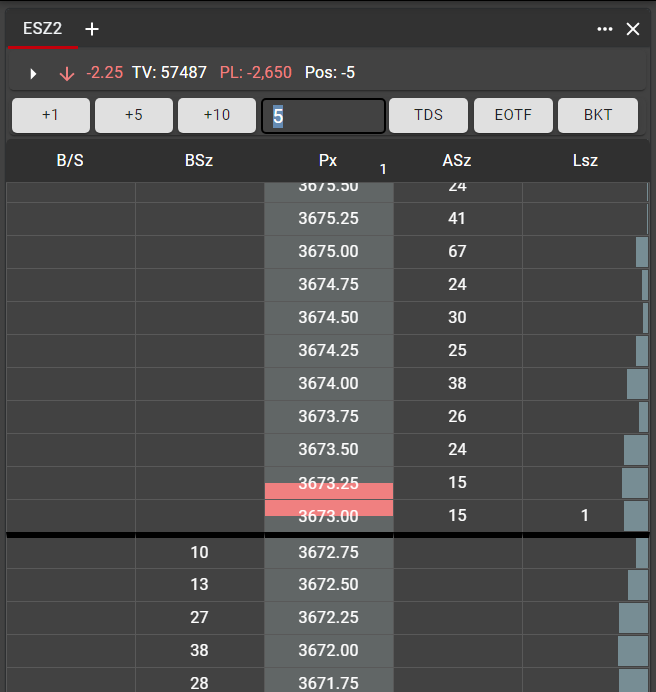

In addition to the displayed position in the top panel of the Ladder, the Average Open price is displayed in the Price Column.

Average Long price is displayed as a green highlighted cell while Average Short price is displayed as a red highlighted cell. This display indicates the average price from which the user is long or short in the instrument, and does not represent the average Buy or Sell price of all fills. This gives the user a visual indication of their open position, irrespective of realized P&L.

If the Average Open price is equal to a displayed price level, that price cell will be highlighted. If the Average Open price is in between displayed price levels, the highlight indicator will straddle the two closest price levels.

Using Synthetic Order Types (Algos) in Ladder

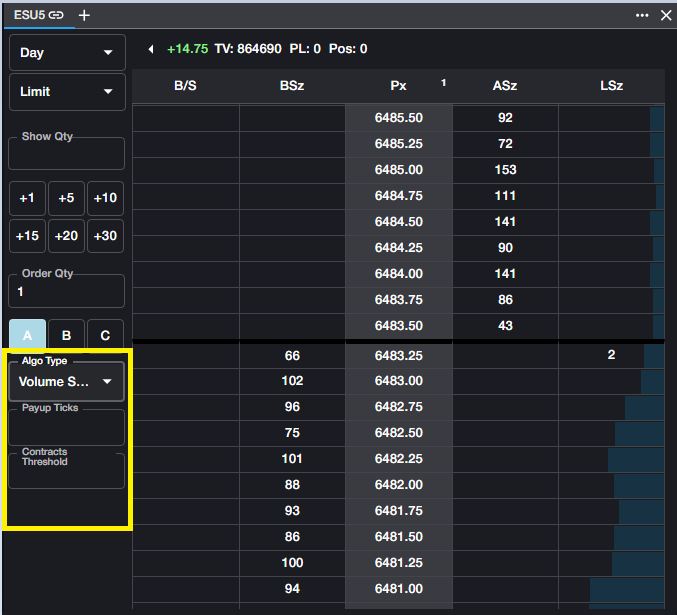

Rival One provides several pre-built synthetic order types, allowing for advanced order management within the parameters of the algos. These algos can be accessed from the A/B/C Algo buttons in the Ladder. Once an order is submitted using an algo, that algo will be assigned to the button from which it was opened, allowing for quicker entry of subsequent algos of the same type.

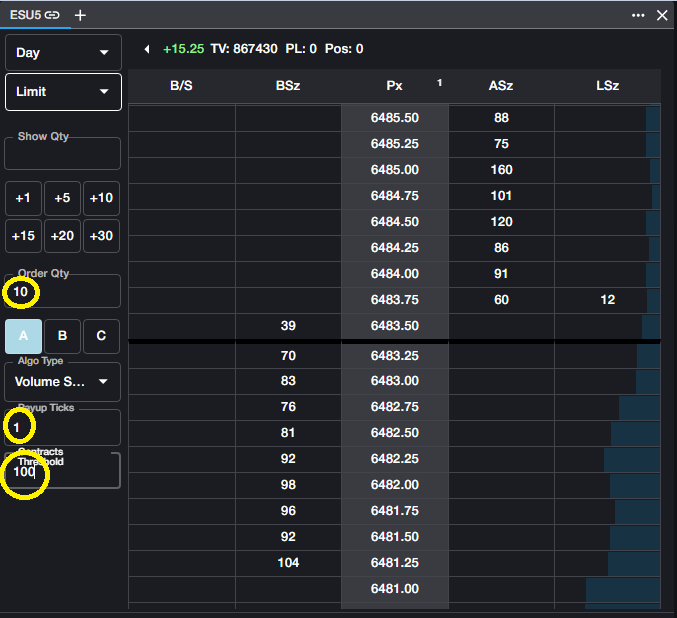

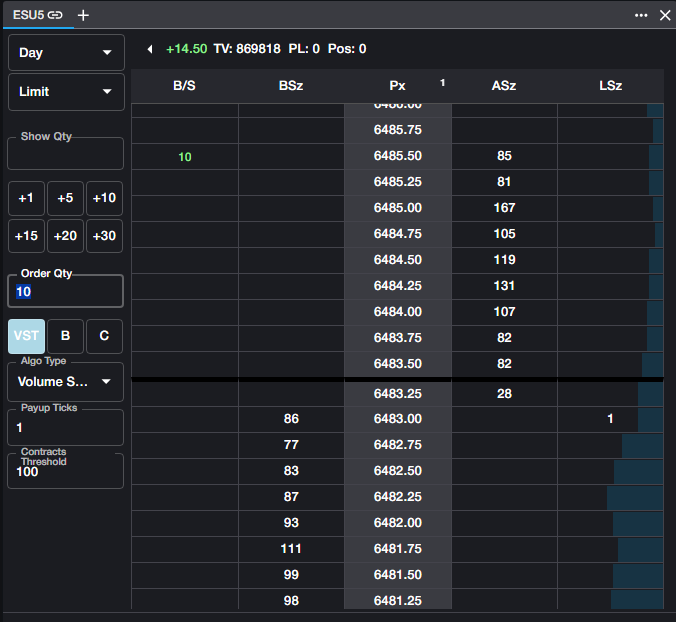

Volume Stop Algo: Volume Stop (abbreviated VST) allows users to enter a synthetic Stop order, managed internally, with a price trigger--as is associated with a traditional Stop order--and an additional Quantity threshold.

Volume Stop will submit a limit order to the exchange at the user's specified stop price, provided that the market quantity on the opposite side is below the user's specified contracts threshold.

Contracts Threshold. This input determines the maximum quantity on the opposite side of the market, below which Volume Stop will trigger.

Payup Ticks. Since Volume Stop submits a Limit order once both trigger conditions are met, users may wish to add some price protection to their order. Payup Ticks determines the number of ticks above the trigger price (for Buy orders) or below the trigger price (for Sell orders) to submit the order to the market. Payup ticks may be set to zero if desired.

Example: In the ESH3 market below, the user wants to submit a Stop order to buy 10 contracts at a price of 3882.50. However, to avoid paying into a large offer, the user only wants the order submitted when the quantity on the offer at 3882.50 is less than 100 contracts.

User will enter a quantity of 10, a Contracts Threshold of 100, and--for this example--a Payup Tick of 1. Once the Algo parameters have been selected, user will enter the order from the Ladder at the desired trigger price.

Order Book will reflect the state of the order, the Algo type, and the trigger price.

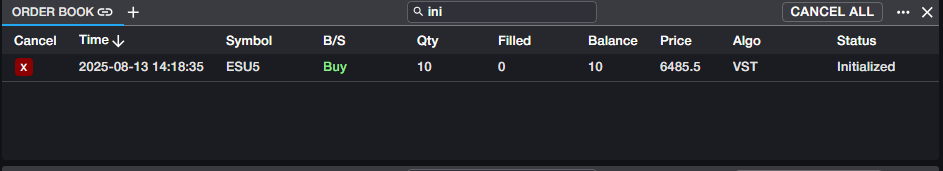

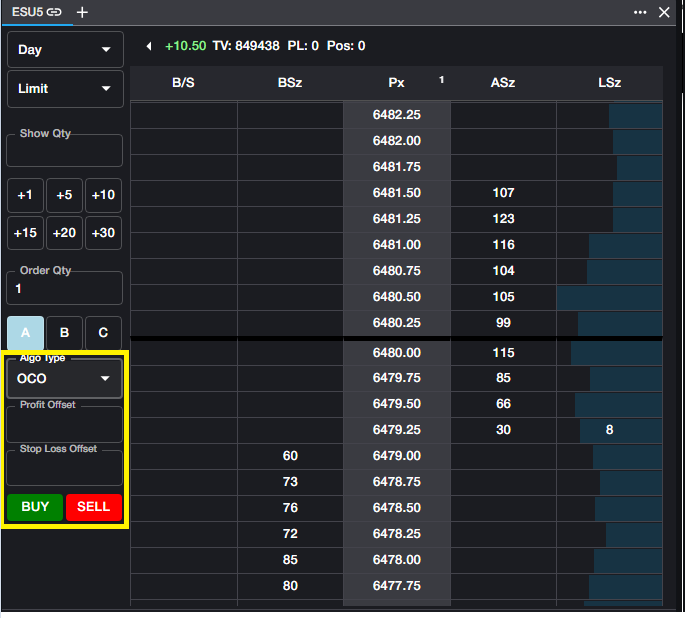

OCO Orders and Bracket Orders OCO (One Cancels Other) and Bracket Orders use the same inputs. An OCO order allows the user to work two orders simultaneously--one to take a profit with the other capping losses with a Stop order. When one order is filled, the other is cancelled automatically. For simplicity, assume a Buy order in the description.

Profit Offset. The number of ticks away from the current market (LTP) at which the user wishes to work a bid.

Stop Loss Offset. The number of ticks away from the current market (LTP) at which the user wishes to place a Buy Stop order.

A Bracket order is an OCO order which is spawned after an execution. For Bracket orders, the functionality is the same as OCO. The difference is that the two parameters are based on executed price of the original Limit order, rather than current market price (LTP)

Eye on the Fly Eye on the Fly (EOTF) has only one input, which is Price. Eye on the Fly will work the user's specified price on the Rival gateway, without exposing the order to the market. Once the specified price level is met, Eye on the Fly will submit a Limit order at the specified price. This is also sometimes referred to as a 'Sniper' order.

Submit on Open Submit on Open will hold an order at the user's specified price level and will submit a Limit order automatically when the market moves from Pre-open to Open state. The only additional input for Submit on Open is Payup Ticks. Payup Ticks specifies the number of ticks the user is willing to sacrifice (pay up or pay down) when the order is submitted to the market.

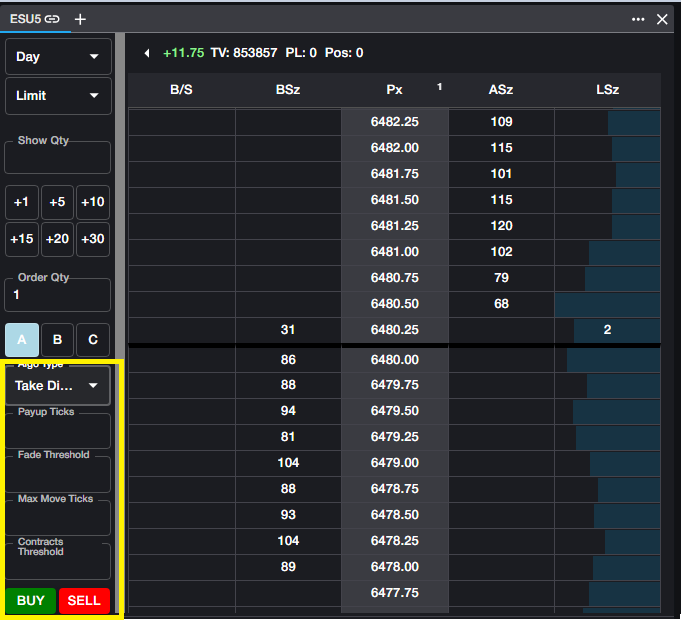

Take Diminishing Size Take Diminishing Size (abbreviated TDS) allows user to work an order with an eye on the total quantity on the other side of the market. When the quantity on the opposite side drops below the user's defined threshold, TDS will pay up (or down) into the market in an attempt to capture the diminishing size of the bid or offer. This algo is sometimes referred to as 'With-a-Tick.'

For simplicity in all examples below, assume a Buy order

Payup Ticks. The number of ticks to pay up in the case that the TDS algo fires. Users may use a larger value in this field to avoid missing a trade in the case that the market is thin or volatile.

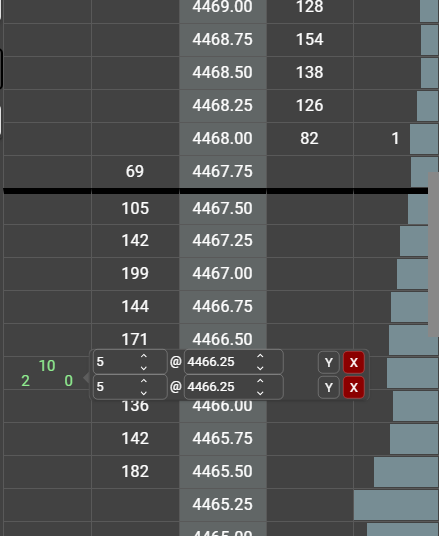

Fade Threshold. This value represents the minimum size required to join the bid. In the above screenshot, if placing a buy order at 4464.50, as long as Fade Threshold is 75 or lower, the algo will join the 4464.50 bid. If Fade Threshold = 100, for example, the algo would join the bid at 4464.25.

Max Move Ticks. This value represents the maximum number of ticks the user is willing to allow the market to move against him before paying up, regardless of the entry price of the order. If the last traded price exceeds the Max Move Ticks set in this parameter, TDS will pay up to the current market price.

Contracts Threshold. The maximum number of contracts offered before the algo pays up to the next level. In the above screenshot, if the user sets Contracts Threshold to 50, TDS will work a 4464.50 bid and montior the quantity offered at 4464.75. If that quantity drops below 50, TDS will pay up to the next price level.

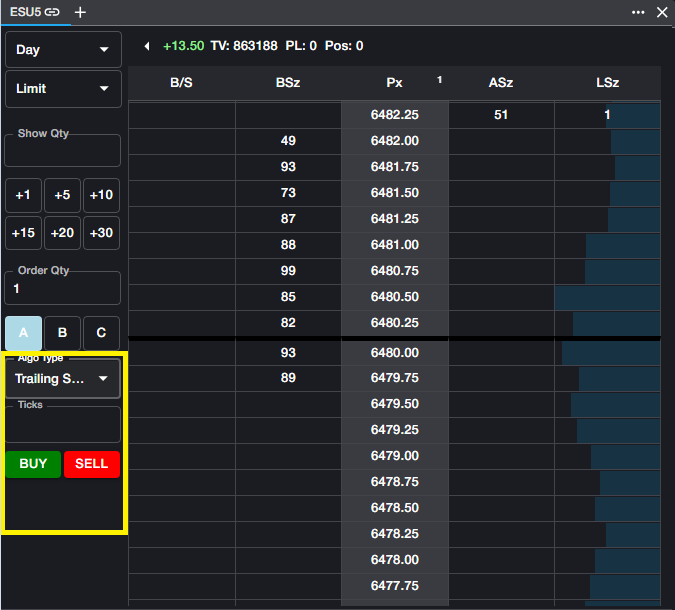

Trailing Stop and Trailing Stop Limit A Trailing Stop order seeks to maximize profit by working a Stop order a specified number of ticks away from the current market (LTP). A Trailing Stop order will trail the market in one direction only. For buy orders, Trailing Stop will follow the bid down, remaining X ticks away from LTP, but will not follow the bid up. For sell orders, Trailing Stop will follow the offer up, remaining X ticks away from LTP, but will not follow the offer down.

The only input for Trailing Stop orders is Ticks, which specifies the number of ticks away from LTP that the Stop order will work and trail. Trailing Stops will be submitted as a Market order when triggered.

For Trailing Stop Limit orders, an additional parameter is introduced. Additional Offset allows the user to specify the number of payup ticks when the Trailing Stop Limit order is triggered, thus submitting a Limit order, rather than a Market order, which would be the case for a Trailing Stop order.

Using Hotkeys in Ladder

When entering orders from the Ladder, users can employ several keyboard shortcuts (Hotkeys) to quickly change the Order Type or TIF.

When a Hotkey is pressed, the Ladder which is currently in focus will be updated according to the user's selection. Press and hold a Hotkey to change the Order Type or Time-in-Force (TIF). As long as the user is holding the Hotkey down, the selection will be active. When the user releases the Hotkey, the selection will automatically revert to the last selection in the Ladder dropdown.

For example: A user has a Ladder in focus, with the Order Type dropdown set to Limit. User wishes to quickly place a Stop order in this Ladder.

User will press and hold the S key on their keyboard. When held down, the user will see that the Order Type dropdown menu in the Ladder will change to Stop. User can now enter Stop orders on the Ladder as long as he is holding the S key down. When the user releases the S key, the Order Type dropdown will revert to Limit (the last manual selection made by the user).

Available Hotkeys:

Order Types

S - Stop Order

L - Limit Order

M - Market Order

T - Stop Limit Order

Times in Force (TIF)

D - Day TIF

G - GTC TIF

I - IOC TIF

E - EXT TIF